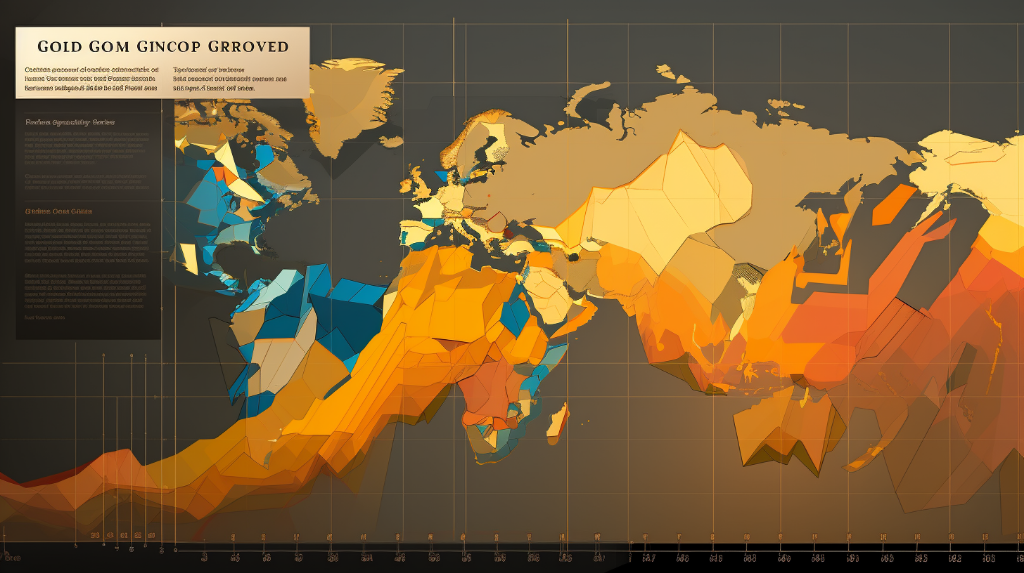

The Importance of Gold Production

Gold, often referred to as the “yellow metal,” has been treasured by civilizations for centuries. Its intrinsic value, rarity, and aesthetic appeal have made it a sought-after commodity throughout history. Beyond its use in jewelry, gold plays a crucial role in economies worldwide. It serves as a hedge against inflation, a reliable store of value, and a safe haven during times of economic uncertainty. The production, distribution, and price dynamics of gold are influenced by various geographical factors.

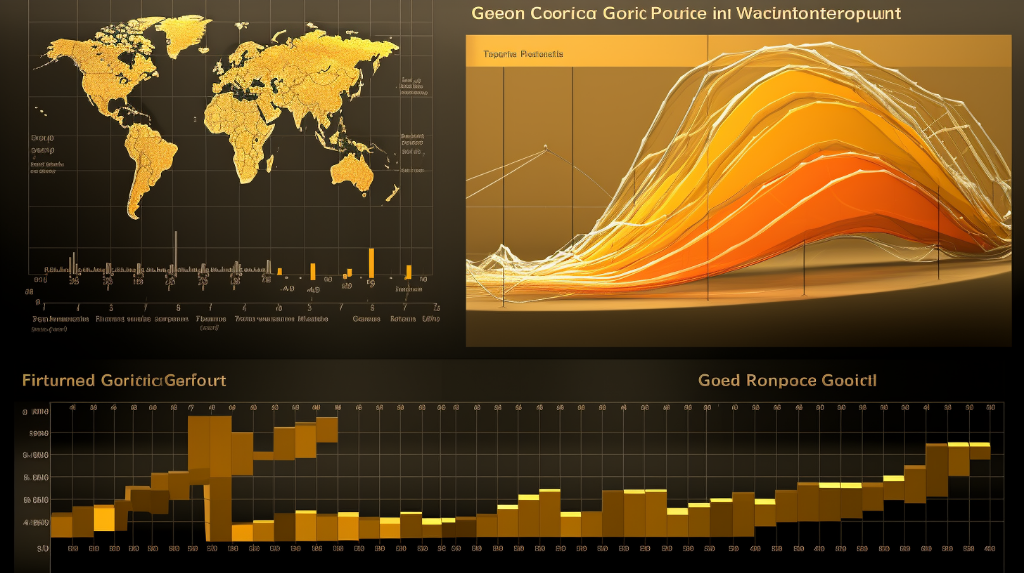

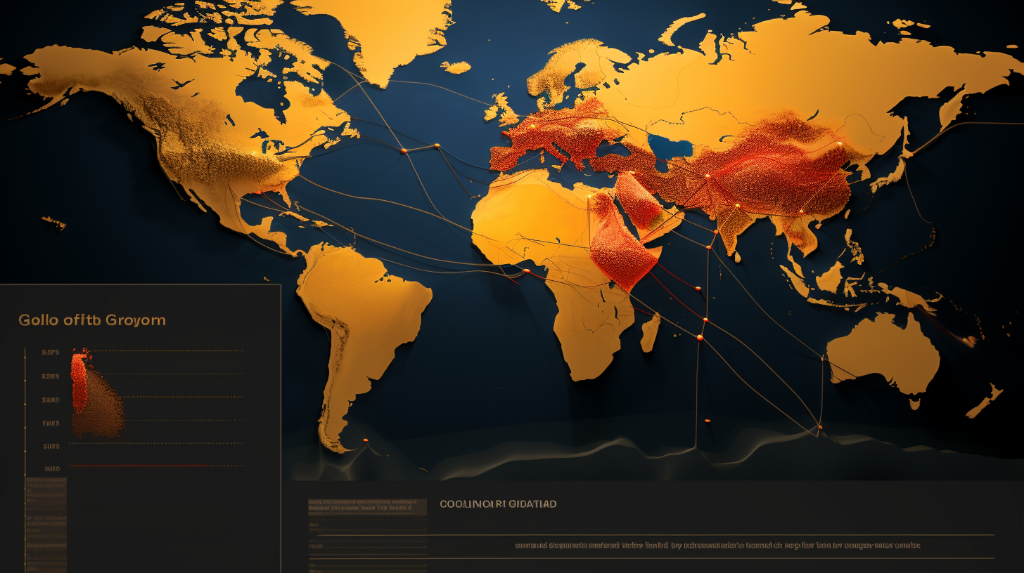

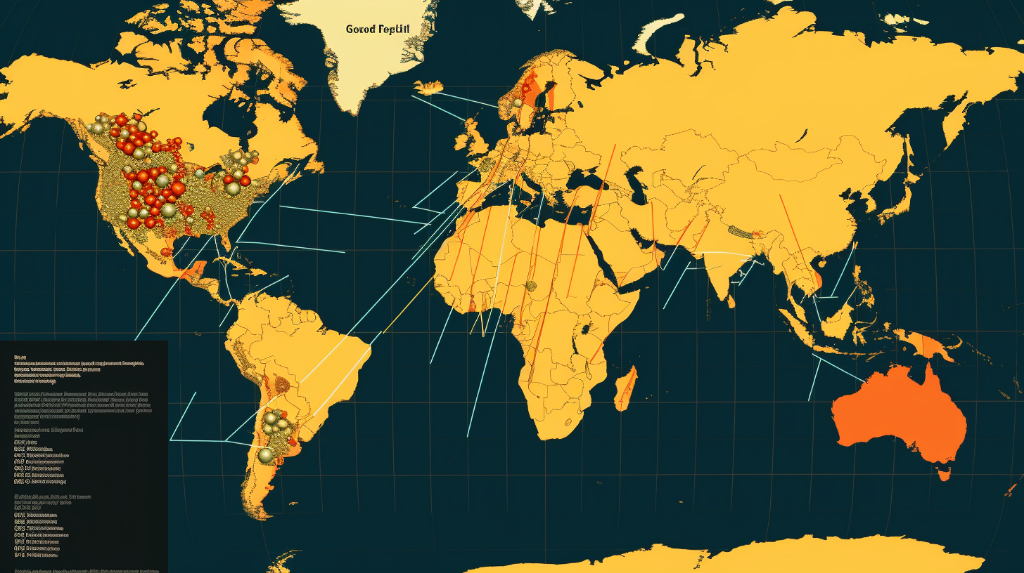

Top Gold Producing Countries

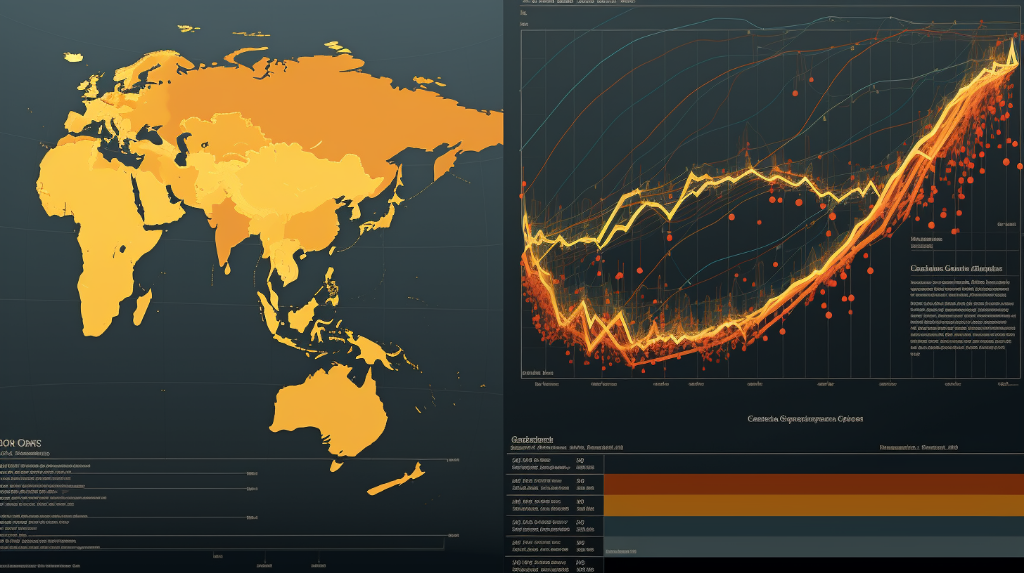

Gold production is concentrated in several key regions across the globe. The leading countries in terms of gold output are China, Australia, Russia, the United States, and Canada. These nations contribute significantly to the global supply of gold and have a significant impact on its price dynamics.

1. China

China has emerged as the world’s largest gold producer, surpassing other nations in recent years. The country’s gold mining industry has experienced rapid growth due to substantial investments in exploration and extraction technologies. China’s abundant reserves and a robust mining sector have enabled it to increase production consistently.

2. Australia

Australia boasts the second-highest gold production globally, thanks to its vast mineral resources. The country’s gold mines are primarily concentrated in Western Australia, where large-scale mining operations extract substantial amounts of the precious metal. Australia’s well-developed mining infrastructure and strict environmental regulations ensure efficient and sustainable gold production.

3. Russia

Russia has a long history of gold mining, with vast reserves spread across its expansive territory. The country benefits from both large, well-established mines in Siberia and new exploration projects in other regions. Russia’s gold production has been on the rise, driven by increased investment and modernization of mining operations.

4. United States

The United States has a diverse gold production landscape, with mines located in various states such as Nevada, Alaska, and California. Nevada, in particular, is known for its prolific gold deposits, making it one of the largest gold-producing regions globally. The country’s advanced mining technologies and favorable investment conditions contribute to its substantial gold output.

5. Canada

Canada’s gold production primarily comes from mines located in the provinces of Ontario, Quebec, and British Columbia. The country’s mining industry adheres to stringent environmental standards, ensuring responsible and sustainable gold extraction. Canada’s stable political climate and favorable investment policies make it an attractive destination for gold mining companies.

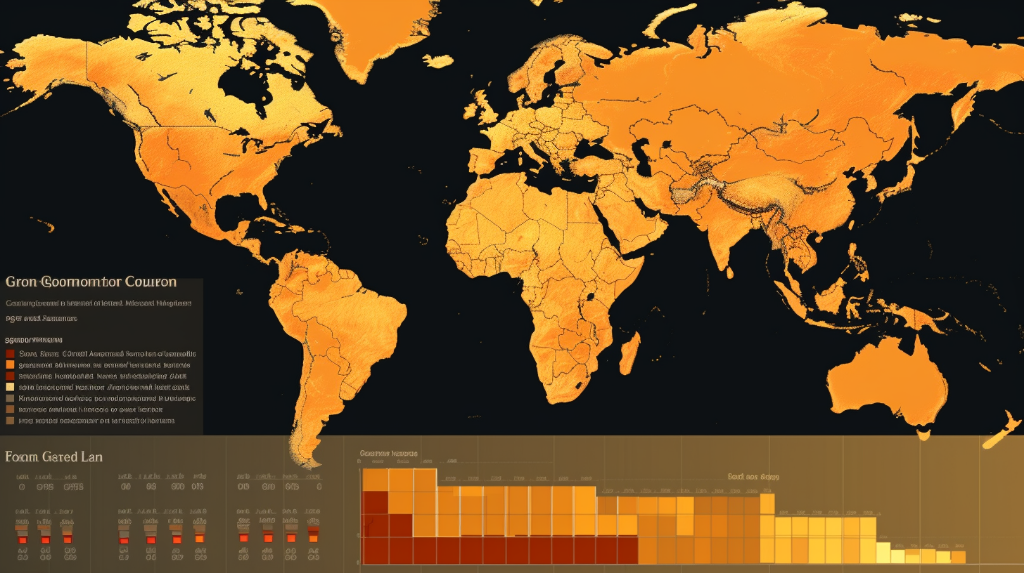

Factors Influencing Price Dynamics

The geography of global gold production plays a crucial role in shaping the price dynamics of this precious metal. Several factors contribute to the relationship between production and price.

1. Supply and Demand

The amount of gold produced globally directly affects its supply. Higher production levels increase supply, which can potentially put downward pressure on prices. Conversely, lower production levels may result in decreased supply and potentially drive prices higher. The balance between supply and demand is vital for price stability.

2. Production Costs

The cost of gold production varies from country to country due to factors such as labor costs, technological advancements, and infrastructure. Countries with low production costs can often sustain profitable mining operations even during periods of lower gold prices. On the other hand, countries with higher production costs may struggle to maintain profitability if prices decline significantly.

3. Political and Economic Stability

The political and economic stability of gold-producing countries can significantly impact price dynamics. A stable country with a favorable investment climate is more likely to attract capital for gold exploration and extraction. This, in turn, can increase production levels and potentially lead to lower prices. Conversely, political instability or economic uncertainties can disrupt production and cause volatility in prices.

4. Exchange Rates

Gold is an internationally traded commodity, and its price is denominated in US dollars. Fluctuations in exchange rates between currencies can influence the price of gold in different countries. A weakening of the US dollar, for example, can make gold more expensive in other currencies and potentially drive up global demand.

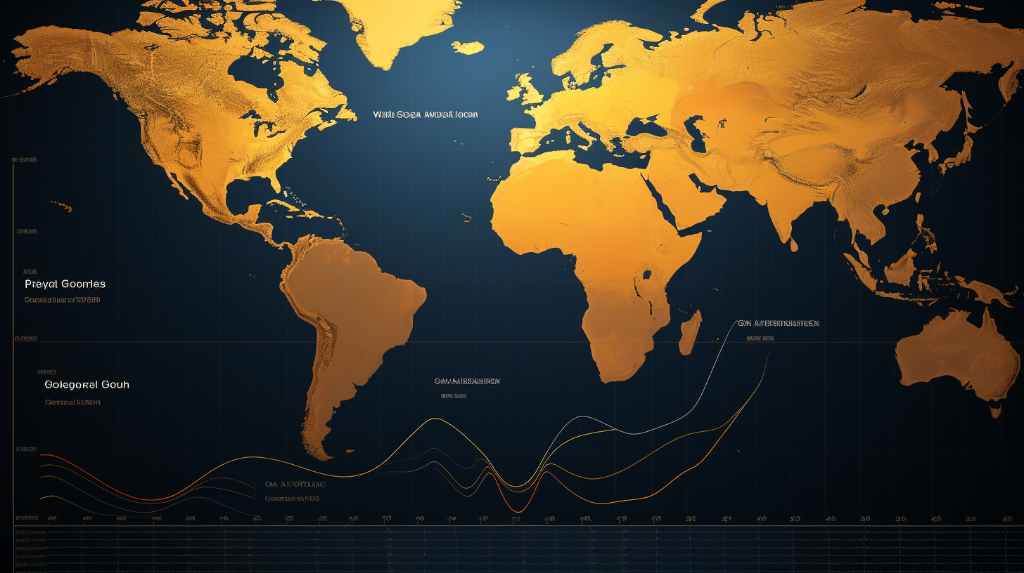

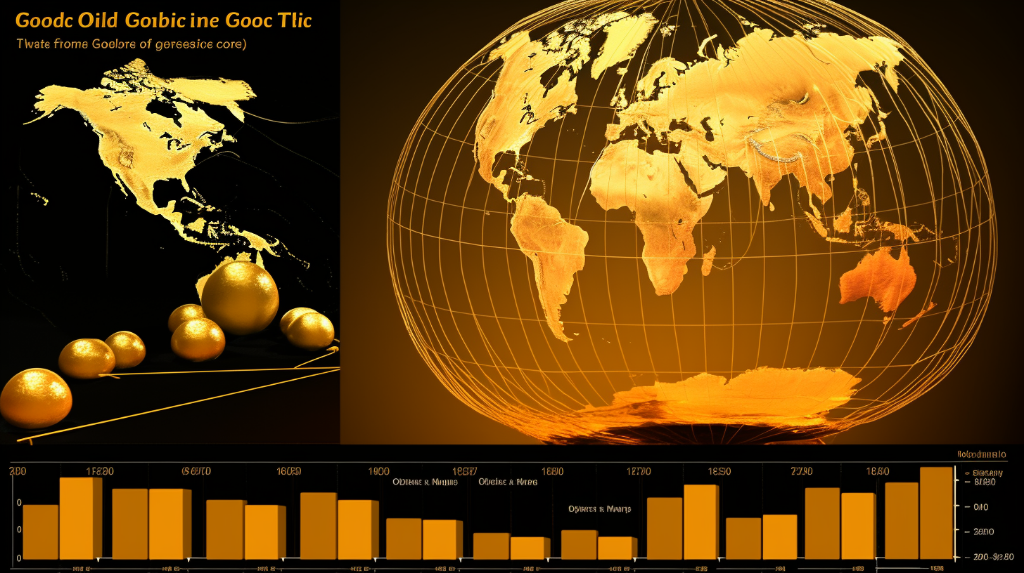

The Future of Gold Production

As global economies continue to evolve, so will the geography of gold production. New discoveries, technological advancements, and changing investment landscapes may shift the balance of gold production across countries. Additionally, environmental concerns and a growing focus on sustainability are likely to influence mining practices and production methods.

In conclusion, the geography of global gold production plays a significant role in shaping price dynamics. Countries like China, Australia, Russia, the United States, and Canada are major contributors to the global gold supply. Factors such as supply and demand, production costs, political stability, and exchange rates all influence the price of gold. Understanding these geographical factors is crucial for investors, industry stakeholders, and anyone interested in the intricate relationship between gold production and its market dynamics.